Markets conditions have shifted rapidly over the past three years, with 2022’s steep downturn veering well away from the optimistic direction and 2021 and the all-around mixed bag of 2020.

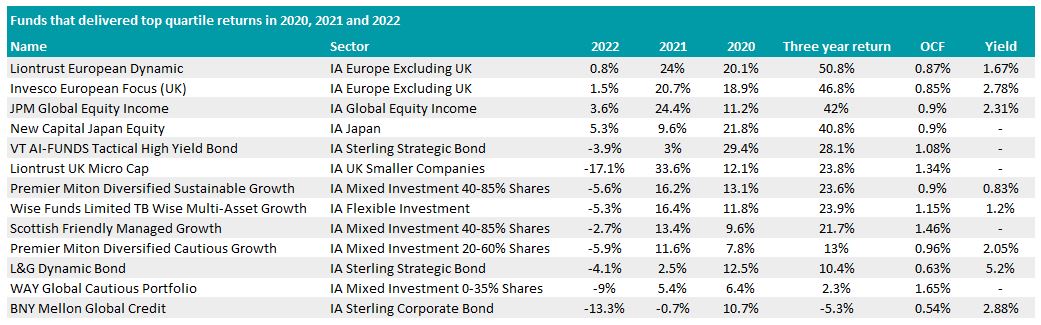

Ian Mortimer, manager of the Guinness Global Equity Income fund, said in 2020 sectors with robust multiple expansion performed the best, but this characteristic alone was not enough to keep them afloat the following year.

He noted: “It was a very difficult year because the pandemic caused earnings to decline significantly from that economic sudden stop.

“In the end, markets made a positive return in 2020 because we saw significant multiple expansion – the market rewarded companies on the expectation that those earnings would come back in future.”

Multiples then began to shrink in 2021, with the most favoured sectors being those that displayed strong earnings growth.

Breakdown of global sector total returns in 2020 and 2021

Source: Guinness Global Investors

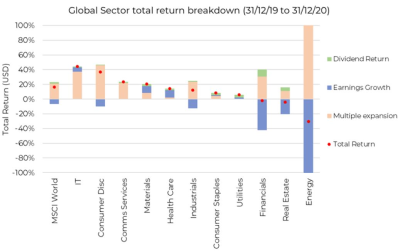

However, the high inflation and interest rates that swept across markets last year caused both earnings growth and multiple expansion to retract in 2022.

As a result, sentiment drifted towards sectors that paid investors an income and “dividends became much more relevant,” according to Mortimer.

He said that there was a strong correlation between high yielders and high returns last year, which was largely driven by the energy sector’s strong performance.

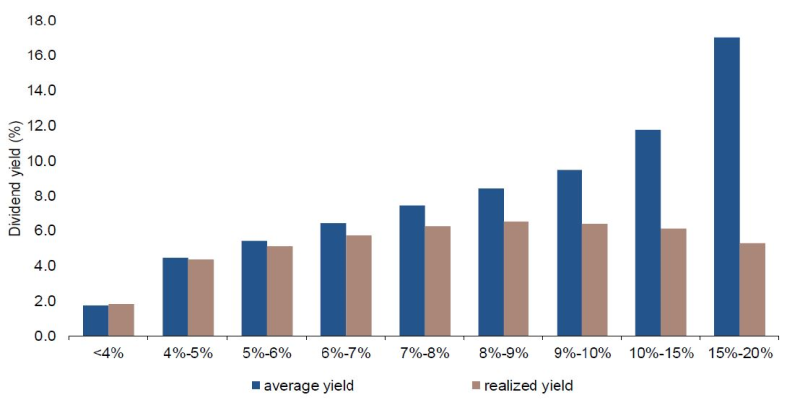

Forecast and realized dividend yields since 1995

Source: Guinness Global Investors

That may have been the case last year, but Mortimer cautioned investors against blindly pursuing big dividend payers in 2023 as they may be disappointed by yield declines in future.

He said: “If you’re chasing the yield up, you’re often investing in more distressed or cyclical businesses. By chasing yields, you’re less and less likely to receive the high yield you’re expecting.”

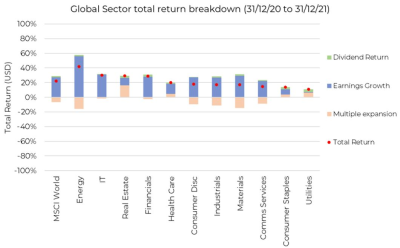

The funds that managed it

Staying on top in a rapidly changing market has been a challenge through the three years as highlighted by the fact that just thirteen of the thousands of funds in the investment association universe have sat in the top quartile of their respective peer groups across 2020, 2021 and 2022.

Source: FE Analytics

However, the likes of Liontrust European Dynamic were able to deliver top-quartile returns in all three years. It made the highest return of any fund on the list over the past three years, climbing 50.8% and landing in the positive in all three.

Its sister fund, Liontrust UK Micro Cap, also made it onto the list, up 23.8% over the past three years, beating its peers in the IA UK Small Cap sector, which were collectively down over the period.

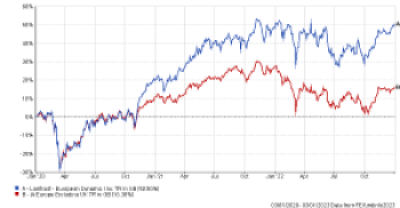

Total return of funds vs their sectors over the past three years

Source: FE Analytics

Performance was strong in 2020 and 2021, but it ended last year on a 17.1% decline, which is still better than the sector’s 25.2% drop in 2022.

Away from Liontrust, the JPM Global Equity Income fund was also able to deliver top-quartile returns in each of the past three years. It was up 42% over the period, beating its peers in the IA Global Equity Income sector by 21.5 percentage points.

Total return of fund vs sector over the past three years

-1.png)

Source: FE Analytics

Two funds managed by Neil Birrell were able to best their respective peer groups in 2020, 2021 and 2022 – the Premier Miton Diversified Sustainable Growth and Premier Miton Cautious Growth funds.

The pair were up 23.6% and 13% respectively over the past three years, beating peers by 18.8 percentage points 12.5 percentage points.

Total return of funds over the past three years

-1.png)

Source: FE Analytics

Some bond funds have also delivered an above average annual return since 2020, with the BNY Mellon Global Credit fund beating the IA Sterling Corporate Bond sector in each of the past three years.

Although it did top its sector in 2020, 2021 and 2022, the fund still ended the three year period down, making a loss of 5.3%.

Total return of fund vs sector over the past three years

-1.png)

Source: FE Analytics

The L&G Dynamic Bond fund was also successful in beating its peer group in all three years but, unlike the BNY Mellon fund above, it ended the period in positive territory up 10.4%, beating the IA Sterling Strategic Bond sector by 15 percentage points.

Its 5.3% yield was also the highest on the list, which could make it attractive to those investing for income.